Knowledge Crunch

Hello there, intrepid Forex trader! We know you’re always hungry for solid, reliable information that can take your trading game to the next level. Whether you’re just dipping your toes into the dynamic Forex market or you’re a seasoned pro with countless trades under your belt, there’s always more to learn, isn’t there? That’s why we’re here today, ready to delve into a key component of your trading journey: “Liquidity in Forex.” Sounds a bit like insider jargon, doesn’t it? But fear not! We’re here to guide you through this intriguing concept, demystifying it and presenting it in a way that you can easily understand and use to your advantage.

Rest assured, by the end of this, you’ll have the answers to your burning questions: What exactly is liquidity in Forex? How does it influence your trading decisions? And, most importantly, why should you pay attention to it?

So, sit back, relax, and keep reading because we’re about to lift the veil on how liquidity can shape your Forex trading strategy. Let’s dive right in!

In simple terms, liquidity in forex refers to the ease with which a currency can be bought or sold without causing a significant change in its price. High liquidity indicates a large number of buyers and sellers, while low liquidity indicates the opposite. Understanding liquidity is important as it affects how quickly you can open and close positions.

There are three main types of liquidity in Forex trading: Market Liquidity, Funding Liquidity, and Central Bank Liquidity.

Market Liquidity refers to the capacity of a market to handle large transactions without causing substantial price changes.

Funding Liquidity is the ease with which traders can get money to trade. Central Bank Liquidity involves the ability of the bank to supply funds to the economy.

The central bank plays a significant role in providing liquidity in the Forex market. By implementing monetary policy, central banks can control the amount of money circulating in an economy, which in turn, impacts the Forex market.

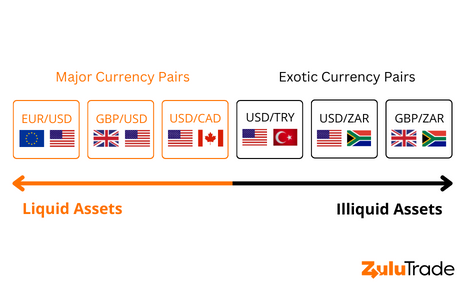

Liquid assets are those that can easily be converted into cash without affecting their market price. Common examples include major currency pairs like EUR/USD or USD/JPY. On the other hand, illiquid assets are the ones which cannot be easily sold or bought without causing a significant price change. These usually include exotic currency pairs.

Illiquidity can be caused by a variety of factors, but the primary ones include limited trading activity, market uncertainty, and economic events. During periods of illiquidity, there can be substantial price swings, and traders may find it hard to execute trades at desired prices.

Liquidity in the Forex market is provided by market participants such as banks, hedge funds, and Forex brokers. These participants form what we call a ‘liquidity pool’. Each one offers different pricing for currency pairs, and together they make the Forex market liquid.

Online Forex brokers play a pivotal role in providing liquidity to the retail market. They connect small retail traders with large market participants. Brokers receive currency quotes from these participants and provide aggregated quotes to traders on their platform.

Liquidity significantly impacts Forex trading. It determines the spreads (the difference between the buying and selling price), which can affect the potential profitability of your trades. A more liquid market often means tighter spreads, which can lead to lower transaction costs.

Choosing the right liquidity provider is a critical decision for Forex traders. Here are a few things to consider:

There you have it – a comprehensive look at liquidity in forex trading. It’s an important piece of the puzzle, influencing how, when, and at what cost you can trade. With a clear understanding of liquidity, you’ll be well-equipped to navigate the turbulent waters of Forex trading. So, remember, keep learning, stay liquid, and happy trading!

Hey there, savvy readers! We know you come to us seeking insights and clarity, especially on topics that can seem a bit complicated. You’ve likely heard murmurs about “trading commodities in 2023” and are wondering what the fuss is all about. Do not worry; we’ve got you covered. Our aim? To demystify the world of […]

As the second largest cryptocurrency (through market cap) in the space right now, Ethereum (ETH) has always been a unique pick from any other crypto. The huge amounts of utility, functioning apps, dapps, smart contracts and a huge role within the NFT space. Eth has solidified itself as a solid crypto project. So today, we […]

Welcome to our latest knowledge crunch. Today’s topic will be stock evaluating. It may sound confusing, but using fundamental tips and advice this blog can help you find long-term investing opportunities. Ratio analysis isn’t only for individual stock pickers, as this type of study also benefits fund investors. Financial ratios are used to compare stocks […]