Navigating the fast-paced world of forex trading can be challenging. But you’re not alone, we’re here to guide you. We understand that you’re seeking clarity on the various currency pairs that dictate the ebb and flow of this vast market. Today, we’ll unravel the complex tapestry of major and minor currency pairs, helping you grasp their unique dynamics and significance.

Rest assured, we will answer all your queries about these currency pairs. We’ll delve into the intricate world of forex trading, helping you decode the jargon and get to the heart of the information you need. This comprehensive overview will give you the confidence to engage with forex trading in a more informed and strategic way. So, stay with us, as we decode the major, minor, and exotic currency pairs in forex trading, and shed light on how to leverage this knowledge for your trading success.

What Are Currency Pairs?

Currency pairs are a fundamental part of Forex (foreign exchange) trading. They represent the value of one currency against another. For instance, if we take the pair USD/EUR, it refers to how much of the Euro (EUR) you can buy with one U.S. Dollar (USD). Traders speculate on the changes in value of these pairs, profiting from the fluctuations.

The Three Types of Currency Pairs

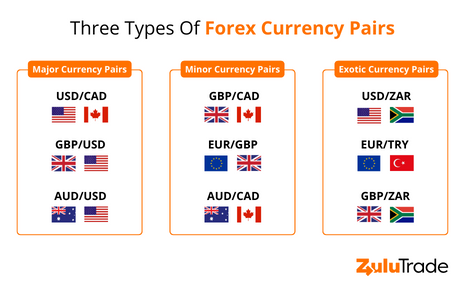

When trading Forex, currency pairs are often grouped into three categories: major, minor, and exotic pairs. Understanding these categories can help traders make informed decisions, as each group has its own characteristics and factors influencing their volatility.

Major Currency Pairs

The U.S. dollar is usually traded alongside the Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Australian Dollar (AUD), Canadian Dollar (CAD), Swiss Franc (CHF), or New Zealand Dollar (NZD). These pairs are the most liquid, meaning they are traded in large volumes. They also often have the lowest spreads.

Minor Currency Pairs

Minor, or cross-currency pairs, exclude the U.S. dollar. These pairs are typically from the major world economies mentioned earlier, such as EUR/GBP or AUD/JPY. While these pairs might not be as heavily traded as major pairs, they can still offer plenty of opportunities for profit.

Exotic Currency Pairs

Exotic currency pairs include one major currency and one from a smaller or emerging economy, like the South African Rand (ZAR) or the Mexican Peso (MXN). While these can be lucrative due to higher volatility, they also carry higher risk and are generally less liquid.

Understanding Major and Minor Currency Pairs Correlation

In the Forex market, currency pairs often move in relation to each other. This movement is known as correlation. To understand this concept, let’s imagine two pairs of dancers on a dance floor.

When the two pairs move in tandem, mimicking each other’s steps, they are positively correlated. This is like a positive correlation in currency pairs. For example, The Euro and the Pound tend to move together with the US Dollar. If the US dollar drops in value, the Euro and the Pound could gain ground against it, pushing the EUR/USD and GBP/USD exchange rates higher.

Trading Currency Pairs

Trading Forex involves buying one currency while simultaneously selling another. In other words, you’re always trading currency pairs. Traders make decisions based on various factors including geopolitical events, economic news, and market sentiment. It’s crucial to have a thorough understanding of the major and minor pairs you’re trading, including their volatility and liquidity.

Finally, major, minor, and exotic currency pairs provide forex traders with a wealth of opportunity. You can improve your trading approach and make better judgements if you are familiar with these groups and the specific pairs that fall within them.

Note: Forex trading involves risk, and it’s important to trade wisely and with informed knowledge.