As an adventurer seeking to conquer the world of forex trading, you’ve likely asked yourself questions about its 24-hour nature. “What are the forex market hours?” “When’s the best time to trade?” Don’t worry, we’ve got you covered. We understand that these questions are essential to navigate the vast financial oceans, and we’re here to make the journey less daunting for you.

Forex trading is a journey that unfolds over time, across various zones, around the world. Unlike a traditional office that works 9-to-5, the forex market hums along 24 hours a day, five days a week. It’s like a relay race that travels from Sydney to Tokyo, onto London, and finally to New York. For you, the trader, this opens a world of opportunities – a market that is always open and ready for business.

But how do you make sense of these different time zones? When is it best to jump in, and when is it wise to step back? How do these trading sessions impact your strategy? We’ll answer these questions and more as we journey into understanding forex market hours, the global trading sessions, and the best times to trade. So, buckle up and keep reading, because this journey is about to get exciting!

Understanding Forex Market Hours

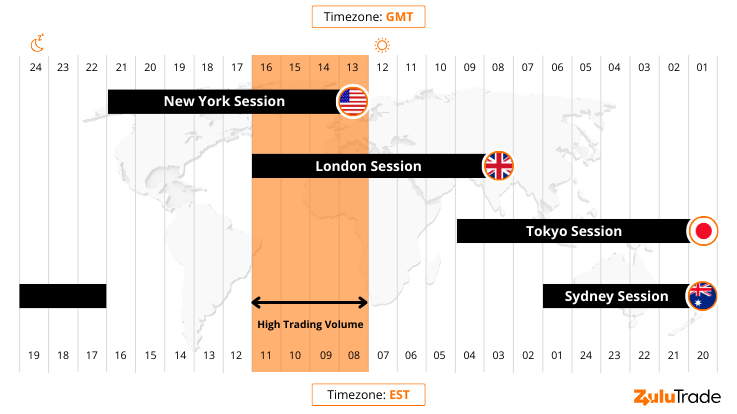

The forex market doesn’t follow the conventional 9-to-5 working hours. Instead, it operates 24 hours a day, five days a week. Imagine this – it’s like a relay race that passes the baton from one financial center to another across different time zones. As one major forex market closes, another one opens. There are four major financial markets that traders usually focus on – Sydney, Tokyo, London, and New York. So, for you, the trader, it means the market is always open for business!

Forex Market Time Zone Converter

“But how do I keep up with all these different time zones?” I hear you ask. That’s where a forex market time zone converter comes in handy. These handy tools automatically translate the opening and closing times of different forex markets into your local time. For instance, while you may be having breakfast in New York, traders in London are wrapping up their trading day. No worries, though, a time zone converter helps you align your trading strategy with the opening and closing times of markets around the world.

When to Trade and When Not To?

Now that you know about forex market hours, the question arises – when should you trade? The best time to trade is during the overlapping hours between two markets. This is when the market is at its most active, leading to greater price fluctuations and opportunities to profit. For example, when the London market and New York market overlap (between 15:00 and 19:00 GMT +3), it’s a hot spot for trading.

Conversely, when a particular market is about to close and another is still hours away from opening, trading tends to be slow, and price movements may be less predictable. So, that’s your cue to take a break!

Understanding Forex Trading Sessions

The four major forex trading sessions are the Sydney session, Tokyo (or Asian) session, London session, and the New York session. Each session has its characteristics in terms of volatility and liquidity.

The Sydney session is where the trading day begins and is followed by the Tokyo session. Together, these two create the Asian session. Next, comes the London session, which overlaps with the late Asian session and the early New York session. The New York session is the last one before the market closes for the weekend.

These sessions impact currency pair volatility. For instance, the Japanese yen usually experiences the most movement during the Asian session, while the Euro is most volatile during the London session.

Bottom Line!

The world of forex trading is dynamic and requires an understanding of several factors. Forex market hours, market sessions, and knowing when to trade are crucial pieces of this puzzle. By keeping an eye on the global trading sessions and utilizing tools like a forex market time zone converter, you can strategize your trading to take advantage of market volatility. Remember, in forex trading, timing is everything! So, trade smart and good luck.