We know you’re here because you’re passionate about forex trading, and you understand that success in this field requires not only a keen eye for market trends but also a deep understanding of the tools that can optimize your trading strategies. One such tool that often generates a lot of buzz in the trading community is leverage. But what is leverage in forex trading, exactly? How does it affect your trading portfolio, and how can you use it to your advantage?

We want to assure you that by the end of this article, you’ll have a clear understanding of leverage in forex trading. You’ll learn how it can magnify your potential profits and the risks that come along with it. So, whether you’re a seasoned trader looking to fine-tune your strategies or a newcomer eager to grasp the mechanics of forex trading, stick with us. Let’s dive into the world of margin and leverage together to help you make well-informed trading decisions.

What is Leverage in Forex Trading?

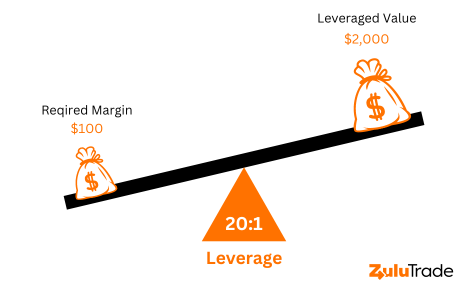

Leverage is a trading tool that allows traders to control bigger amounts of money in the forex market with a relatively small investment. Basically, it’s a type of loan that your broker offers you, helping you maximize your trading capacity. But remember, along with the increased potential for profits, leverage also amplifies potential losses.

For instance, a leverage ratio of 100:1 means you can control a $100,000 trade with just $1,000 in your account. Forex trading with such high leverage can potentially lead to substantial profits if the market moves in your favor.

Understanding Leverage Trading in CFDs

Contracts for Difference, or CFDs, offer another way to participate in forex trading. A CFD allows you to speculate on price movements without actually owning the underlying asset. Just like forex, you can use leverage when trading CFDs, potentially amplifying your returns but also magnifying your losses.

How to Determine How Much Leverage for Forex Trading

Determining the right amount of leverage largely depends on your risk tolerance and trading strategy. If you’re a conservative trader with a low risk tolerance, you might choose lower leverage, such as 10:1 or 20:1. Conversely, if you’re more aggressive and comfortable with risk, you might opt for bigger leverage ratios

What is a Good Leverage for Forex?

There’s no universal answer to what constitutes good leverage in forex trading. While a high leverage ratio like 100:1 or 200:1 may seem attractive due to the potential for large profits, it’s also riskier. For beginners, a lower leverage, such as 10:1 or 20:1, might be advisable until they get a solid grasp of market dynamics.

Types of Leverage Ratios in Forex

There are several types of leverage ratios available in forex trading, often ranging from as low as 2:1 to as high as 500:1. However, regulators in some countries have imposed limits on the maximum leverage that brokers can offer to protect traders from excessive risk.

Risks of Leverage in Forex Trading

Leverage, as we’ve seen, can work both ways. It has the potential to multiply gains but also to aggravate losses. If the market turns against you, you could lose a lot of money. Because of this possibility, a solid risk management approach is required when employing leverage in FX trading.

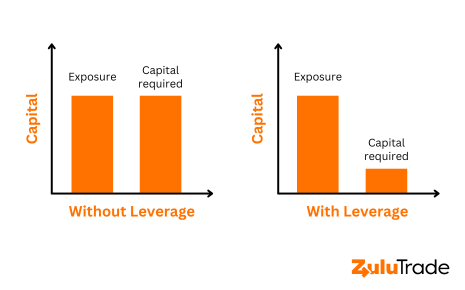

Forex Trading without Leverage

Yes, forex trading can be done without leverage too. This practice is known as ‘full margin’ trading where traders use only their own capital. Trading without leverage reduces the risk of significant losses but also limits the potential profits. This approach might be preferable for those who are particularly risk-averse or new to forex trading.

In conclusion, leverage is a powerful tool in forex trading that, if used wisely, can enhance your trading potential significantly. However, it’s not without its risks. As a trader, understanding the role of margin and leverage, and knowing how to use them effectively, is essential for successful forex trading. Always remember that trading is not only about making profits but also about managing and mitigating losses.

FAQs

1.Does leverage affect profit?

Yes, leverage can significantly affect your profit in forex trading. By using leverage, traders can control larger positions than they could with their own capital alone. This means that if the market moves in your favor, your profits can be greatly multiplied. However, the opposite is also true. If the market moves against you, your losses can be just as magnified, potentially exceeding your original investment.

2.Can I trade forex without leverage?

Absolutely, you can trade forex without leverage. This is known as ‘full margin’ trading, where you only use your own capital to make trades. While this approach significantly reduces the risk of incurring large losses, it also limits your potential profits because you’re only trading with the money you have, not with any additional borrowed funds.

3.What is the safest leverage in forex?

The ‘safest’ leverage in forex trading can vary greatly depending on the trader’s experience, risk tolerance, and trading strategy. For beginners or those with a low risk tolerance, lower leverage ratios, such as 10:1 or 20:1, are often recommended. These lower ratios can help limit potential losses while the trader gains experience and develops a robust trading strategy.

4.Is leverage trading illegal?

Leverage trading is not illegal; in fact, it’s a common practice in various financial markets, including forex, stocks, and commodities. However, due to the high risk associated with leverage trading, many regulatory bodies worldwide impose limits on the maximum leverage that brokers can offer to their clients. These limits are designed to protect traders from excessive risk and potential significant losses. It’s always crucial to trade with a regulated broker that adheres to these guidelines.