We understand that as a savvy individual interested in expanding your financial knowledge, you might have questions about this concept known as “leverage in CFD trading.” We know that it can seem like a complex puzzle. But guess what? You can solve this puzzle, we’re here to reassure you of that!

We’ll clear the air on leverage in this post, answering topics like: What is leverage in CFD trading? How does it function? What are some advantages and disadvantages?

Take a deep breath because by the time you’re done reading, you will understand this topic well enough. Let us now go on this financial journey together.

Understanding CFD: The Basics

Before we get into leverage in CFD trading, let’s take a step back and review what CFDs are in the first place.

CFD stands for Contracts for Difference. But exactly what does that mean? Essentially, CFDs are a type of derivative trading. In simpler terms, when you trade CFDs, you’re not buying or selling a physical asset like a stock or a commodity. Instead, you’re buying or selling a contract that represents this asset. To know more about CFDs in detail, you can read our intensive topic here.

The Power of Leverage in CFD Trading: How Does it Work?

Now that we’ve set the stage with a clear understanding of CFDs, let’s proceed to the heart of our discussion: the concept of leverage in CFD trading.

In simple terms, leverage refers to the use of borrowed capital (in this case, from your broker) to increase the potential return of an investment. You can think of it as a loan that allows you to gain exposure to a large amount of an asset without having to pay the full price upfront.

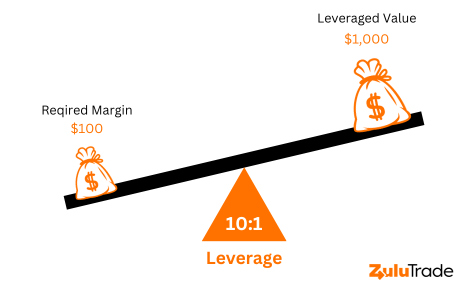

The ratio of the total amount of the investment to the amount of the initial deposit is called the leverage ratio, and it’s typically expressed as a multiple, like 2:1, 10:1, or even 100:1. The initial deposit, also known as margin, is the portion of the investment that you need to provide.

Let’s look at an example. Suppose a broker offers a leverage of 10:1. This means that for every $1 of your own money, you can trade $10 worth of a certain asset. If you have $1,000 to invest, you can trade $10,000 worth of an asset.

But how does this increase your potential return? Let’s say you’re trading a CFD on a stock, and the stock’s price goes up by 5%. If you invested $1,000 without leverage, your profit would be $50. However, with the 10:1 leverage, you were able to trade $10,000 worth of the stock. So, a 5% increase would result in a profit of $500.

This is the power of leverage in CFD trading – it magnifies your potential profits. But it’s not all sunshine and roses. Leverage is a double-edged sword because it can also magnify your losses if the market doesn’t move in the direction you predicted. In the above example, if the stock’s price fell by 5%, you would lose $500 instead of just $50.

This potential for larger losses is the primary risk associated with leverage, and it’s crucial to manage this risk carefully. Remember, trading on margin means that you can lose more than your initial deposit. That’s why risk management strategies, such as setting stop-loss orders and limiting the size of your trades, are crucial when trading with leverage.

In the next section, we’ll dive deeper into the advantages and risks of leverage in CFD trading.

The Benefits of Leverage in CFD Trading

Now that we’ve explored how leverage works in CFD trading, let’s delve into its key benefits. These advantages often make leverage an attractive proposition for traders.

- Enhanced Profit Potential: The most significant benefit of leverage in CFD trading is that it can substantially amplify your profits, as we’ve already explained with our previous example. With the power of leverage, a small price movement in the underlying asset can yield substantial returns on your initial investment.

- Access to Larger Market Positions: Leverage provides the ability to control larger positions in the market with a relatively small amount of capital. This means you can gain exposure to high-value assets or markets that might have been out of reach without leverage.

- Diversification: With leverage, you don’t need to tie up large amounts of your capital in one investment. This can free up funds that you may use to diversify your trading portfolio by investing in a number of assets. Remember, diversification can help spread your risk, but it doesn’t guarantee a profit or protect against loss.

- Opportunity to Trade in Any Market Condition: Leverage in CFD trading allows you to potentially profit from both rising and falling markets. Whether you believe an asset’s price will go up (going long) or down (going short), you can use leverage to increase your market exposure and potentially profit from price movements in either direction.

Though leverage can be helpful for CFD traders, it can be risky too, as we’ll talk about next. Like with any financial strategy, it’s really important to know both the good and bad sides before you use leverage in your CFD trading.

The Drawbacks of Leverage: A Word of Caution

As we’ve discussed, leverage in CFD trading can serve as a powerful tool that boosts potential profits. But it’s crucial to remember that the sword of leverage is double-edged, meaning the potential for losses is equally magnified. Some disadvantages of using leverage are:

- Magnified Losses: Just as leverage can amplify profits, it can equally magnify losses. When a trade doesn’t go your way, leverage will multiply the amount you stand to lose. As demonstrated in our earlier examples, a small drop in the market can lead to significant losses when leverage is at play.

- Losses Can Exceed Deposits: One of the most crucial points to remember with leverage is that you could potentially lose more than your initial deposit or margin. In a worst-case scenario, if a trade goes significantly against you, you could end up owing money to your broker.

- Fast-Paced Market Fluctuations: Leveraged trading can be stressful and may require constant monitoring. The market is volatile and when leverage is included, these changes can have a significant impact on your trading position.

- Margin Calls: If your trade starts to move against you and your account balance falls below a certain level, known as the margin requirement, your broker may issue a “margin call.” This is a request for you to deposit additional funds into your account to maintain your position. If you can’t meet the margin call, your broker may close your position, and you’ll be responsible for any loss.

- Interest Charges: Leveraged positions that are kept open overnight may be subject to interest charges, also known as overnight or swap fees. These expenses can pile up over time and reduce your possible earnings.

Final Thoughts

Leverage in CFD trading can be a powerful tool when used correctly and responsibly. It’s important to understand both its benefits and risks before getting started. Always remember, while the potential for higher profits can be enticing, it comes with an equal potential for losses. Learn, plan your strategy well, and make sure you’re handling risks smartly. That’s the way to do well in CFD trading. Happy trading!

Note: Trading in CFDs and generally with leverage, comes with significant risk and may not be suitable for all investors.

Frequently Asked Questions (FAQs)

What is the minimum amount of leverage I can use in CFD trading?

The minimum amount of leverage varies depending on the broker and the type of asset you are trading. Some brokers may offer a leverage ratio as low as 1:1, which essentially means you’re trading without leverage. Always check the specific terms and conditions set by your broker

Are there any limits to how much leverage I can use?

The amount of leverage you can use depends on your country’s rules and the policies of your broker. Different countries have rules to make sure traders don’t take on too much risk.

Is it possible to trade CFDs without leverage?

Yes, it’s possible to trade CFDs without leverage by using a 1:1 leverage ratio, meaning you’re investing the full amount of the asset’s value. However, one of the main appeals of CFD trading is the ability to use leverage, so trading without it may not offer the same potential returns.

How can I manage the risks of leverage in CFD trading?

To control the risks of leveraged trading, there are many different ways. These include setting stop-loss orders to limit potential losses, using take-profit orders to secure profits, maintaining a diversified portfolio, and using only a small portion of your capital for each trade. Keeping up with how the market is doing and changing your plans when needed is important. Keep in mind, knowing CFDs and leverage well is your top way to handle these risks.

Is it possible to trade CFDs without leverage?

Yes, it’s possible to trade CFDs without leverage by using a 1:1 leverage ratio, meaning you’re investing the full amount of the asset’s value. However, one of the main appeals of CFD trading is the ability to use leverage, so trading without it may not offer the same potential returns.