Ever wondered why some forex traders seem to have a sixth sense when it comes to predicting market movements? Well, it’s not clairvoyance – it’s understanding how to trade forex on news releases. From anticipating the widening of spreads during major economic events to navigating the slippage increases due to high volatility, these skilled individuals have learned how to harness the power of news to their advantage.

So, what’s their secret? Come along for the ride! We’re about to unpack this strategy and show you how to make it work in your favor. Ready to dive in?

Why Trade the News?

An analogy that might help is to think of the forex market as an ocean. Usually, the waters are calm, with gentle waves – or price fluctuations – occurring throughout the day. This is the normal ebb and flow of the market. But when a major news release drops, it’s as if a massive stone has been thrown into that peaceful ocean. It causes significant ripples, or in the context of forex trading, major price swings.

Now, imagine you’re a surfer (or trader) on this ocean. Normally, you’d ride the small waves for fun, but when a big one comes, you have the chance to ride a much more exciting and profitable wave. That’s essentially what trading the news is – it’s about anticipating and riding these big waves caused by significant news releases.

So why should you trade forex on news releases? The answer is straightforward. Major news events have the potential to cause significant price movements in the forex market. It could be the announcement of a change in interest rates by the Federal Reserve, an unexpectedly high jobs report, or even a geopolitical event like a major election. These events can lead to large swings in currency values as traders around the world react to the news.

Trading the news allows you to capitalize on these large movements, potentially earning more profit than during normal market conditions. Like with all things trading, you’ve got to know the ropes and be smart about where you put your money. Catching those huge waves? Super thrilling! But it’s not just about the thrill – you need the right skills, a bit of know-how, and a keen sense of what the market’s up to.

Widening of Spreads during Major Economic Events

Carrying forward the ocean analogy, let’s talk about the widening of spreads during major economic events. In foreign exchange, spreads are the difference between the asking price and the actual asking price of a currency pair. It’s like the distance between two waves in our ocean.

Under regular conditions, these waves (or spreads) maintain a consistent distance from one another. The waters are calm and predictable, allowing you to easily surf from one wave to the next. However, when a significant event like an economic release happens, it’s as if a storm has hit the ocean. The calm, evenly spaced waves are replaced by unpredictable, chaotic ones that crash against each other with varying degrees of intensity and distance apart.

This storm represents the uncertainty in the market during major economic events. Traders and brokers are unsure about the effect of the news release on the currency values. This uncertainty leads to a decrease in the liquidity of the currency pair – it’s like fewer surfers (or traders) are willing to risk riding the waves during the storm. As a result, brokers increase the spread or the distance between the waves to protect themselves from potential losses.

In this turbulent scenario, understanding how to navigate these wider spreads becomes crucial. If you, as a forex trader, can anticipate these wider spreads or bigger waves, you can adjust your strategy accordingly. Maybe you wait out the storm, or perhaps you see the larger waves as an exciting challenge. Either way, your strategy needs to account for these larger spreads to prevent your trades from wiping out. Remember, a skilled surfer not only knows how to ride the waves but also when to ride them. Similarly, a successful forex trader isn’t just about making profitable trades, but also about knowing when to make those trades.

Slippage Increases due to High Volatility

To continue with our ocean analogy, think of slippage as trying to catch a specific wave, but instead of catching the wave you intended, you find yourself riding the next one, which is bigger or smaller than you anticipated.

In the calm, everyday trading conditions of the forex ocean, catching your chosen wave is pretty straightforward. You can predict the size of the wave and ride it to the shore, just as in forex trading, you can predict the price at which your order will be executed.

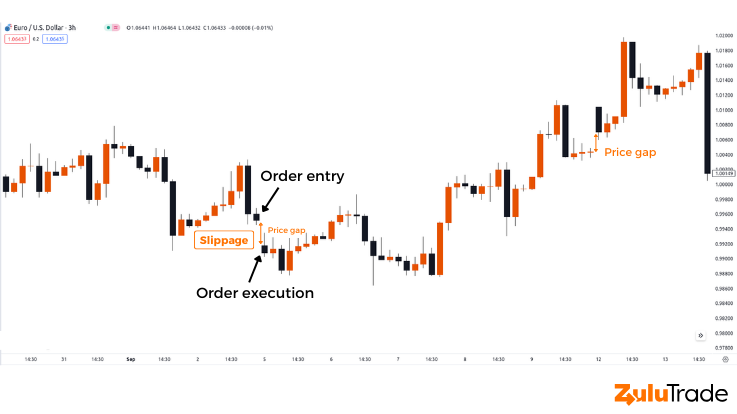

However, when there’s high volatility in the market due to significant news releases, it’s like a storm has come in and the sea has become unpredictable. You paddle to catch a wave at a specific point, but the wave crashes sooner or later than you expected. You end up catching a completely different wave. This unpredictability, this discrepancy between the wave you wanted to catch and the wave you ended up on, is much like the concept of slippage in forex trading.

Slippage occurs when an order is filled at a different price than expected. In a volatile market, the price of a currency pair can change rapidly in a very short time, causing an order to be executed at a price that is either higher or lower than what was initially requested.

As a trader, slippage can seem daunting – after all, it’s easier to surf when the waves are predictable. But volatility is not always a bad thing. Just like how expert surfers can ride the unpredictability of stormy seas to their advantage, skilled forex traders can leverage the increased volatility during news releases to maximize their gains. Understanding how to manage and mitigate the risks of slippage can turn an unexpected wave into an opportunity for a thrilling ride and profitable trade.

How to Trade Forex on News Releases

Alright, let’s get down to the details!

If you’re looking to trade forex on news releases, there are a few steps you’ve got to follow.

How to Find Events that Produce Volatility

First things first: keep a keen eye on an economic calendar. It lists important financial events, speeches, and reports that can cause volatility in the forex market. Pay special attention to news from the larger economies of the world, such as the U.S, China, and the Eurozone, as these tend to have the most significant impact.

2 Ways to Trade the News

There are primarily two strategies to trade forex on news releases – directional bias and non-directional bias.

Directional Bias

Here, traders predict the outcome of a news release and place a trade accordingly. For instance, if a trader believes that an upcoming employment report will beat expectations, they may decide to buy the currency, anticipating that its value will increase after the news release.

Non-Directional Bias

This strategy doesn’t involve predicting the outcome of the news. Instead, traders set up triggers to buy or sell a currency pair when it moves significantly after the news release. This way, they can profit from market volatility, regardless of the direction the market moves.

The Bottom Line!

Understanding how to trade forex on news releases requires a bit of practice and a lot of patience. However, with the right approach, you can turn news releases into opportunities. By keeping a close eye on the economic calendar, understanding the nuances of spread widening and slippage, and deploying effective trading strategies, you too can become proficient at this exciting form of forex trading.

And remember – knowledge is power. The more you understand about how news affects the forex market, the better equipped you’ll be to use this information to your advantage. So keep learning, keep trading, and most importantly, keep enjoying the process. Happy trading!

Frequently Asked Questions (FAQs)

What types of news releases have the most impact on the forex market?

High impact news events often have the most significant effect on the forex market. These could be macroeconomic data like GDP, employment figures, interest rate decisions, or unexpected geopolitical events. The events from larger economies like the U.S., China, and the Eurozone typically have a broader impact.

How can I prepare myself before trading the news?

Preparation is key when it comes to news trading. Always keep an eye on an economic calendar, which lists upcoming news events. Research the event to understand how it might impact the market and form a trading plan based on various possible outcomes. Remember, managing your risk is crucial during volatile periods.

Can news trading be profitable for beginners in forex trading?

News trading can indeed be profitable, but it also comes with increased risk due to the volatility of the market during major news releases. As a beginner, it’s essential to understand these risks and start with a demo account before risking real money. Over time, as you gain more experience and knowledge, you can develop a news trading strategy that suits your trading style and risk tolerance.

How can I manage slippage while trading the news?

Slippage is a common occurrence in high-volatility markets, and it can’t always be avoided. However, you can manage it by using limit orders instead of market orders, which allow you to set a maximum acceptable price for a trade. Additionally, ensure you have a good understanding of the market and the specific news event to make informed decisions. Remember, risk management should always be a priority in forex trading.