Hello, Forex enthusiasts! We’ve heard your burning questions and deep desire to understand the crucial elements that drive the Forex market. We acknowledge the curiosity bubbling inside you: how do interest rates fit into the grand scheme of Forex trading? And more importantly, why do these percentages matter so much in the ebbs and flows of currency exchange?

Well, we’re here to reassure you: you’ve found the right place. We will break down the key concepts and make the world of interest rates accessible and relatable. So, let’s start unraveling this intricate tapestry of Forex trading together, beginning with the fundamental question: Why do interest rates matter in Forex trading?

By the end of our journey, you’ll not only grasp why interest rates matter in Forex trading but also see how they influence currency values and trader decisions.

The Interest Rate Basics

At first glance, interest rates can seem daunting. But before understanding why Interest Rates matter in Forex Trading, let’s break it down to its core: What exactly is an interest rate?

Imagine you are a person with $100 that you don’t need right now. You have two options: you could keep that money under your mattress, or you could lend it to someone who needs it now, let’s say, to start a business or buy a car. However, you want to be compensated for this act since you’re giving up the opportunity to use this money right away. That’s where the concept of interest comes in.

Interest is essentially a fee that borrowers pay lenders for the privilege of using their money. In this scenario, if you lend your $100 at an interest rate of 2% per year, at the end of one year, you would receive your original $100 back, plus $2 in interest.

But who sets these interest rates? Enter central banks, like the Federal Reserve in the U.S., the Bank of England in the UK, or the European Central Bank in the Eurozone. These institutions adjust interest rates to manage their countries’ economic health.

How does this relate to forex trading, then? Well, in the same way you might lend your money to earn interest, international investors lend their money to different countries by buying those countries’ bonds. These bonds have interest rates set by the countries’ central banks. Therefore, the interest rates set by these banks directly impact Forex trading by influencing where investors decide to put their money.

Therefore, interest rates are more than just numerical values. They’re powerful economic tools that help manage national economies and are key to understanding the complex dynamics of Forex trading.

How Rates Are Determined?

Interest rates aren’t random numbers plucked out of thin air; they’re carefully calculated figures set by central banks, such as the Federal Reserve in the U.S. The purpose? To manage the nation’s economy.

Imagine a vast ship – the economy. The captain, or the central bank, needs to make sure the ship sails smoothly. It shouldn’t move too fast, leading to uncontrollable inflation, nor too slow, causing recession. The primary tool at the captain’s disposal is the interest rate, which can be thought of as the ship’s throttle.

Now, you may wonder why interest rates matter in Forex trading. Well, they do because they can influence the relative strength of currencies. Higher interest rates typically attract foreign investment looking for the best return on investments, which in turn can elevate the value of that nation’s currency.

Let’s take an example. Suppose the economy is overheating, like a ship moving too fast. Prices are soaring (inflation), and the value of money is decreasing. To cool things down, the central bank will raise interest rates. Borrowing money becomes more expensive when interest rates rise. Consequently, people and businesses borrow less, spend less, and the economy slows down. This slowdown can help control inflation and stabilize the economy.

On the flip side, if the economy is in a slump, the central bank lowers interest rates to encourage growth. Borrowing is more affordable when interest rates are low, enticing more people and businesses to borrow, which leads to higher spending. This increased spending can stimulate economic growth.

This intricate dance of raising and lowering interest rates is what helps keep an economy balanced and stable. When rates change, they affect everything, from the cost of homes to the dynamics of Forex trading. As such, everyone from big financial centers to regular folks pays close attention to these shifts.

Why Interest Rates matter in Forex Trading?

Picture yourself as a seasoned sailor, navigating the vast ocean of the Forex market. Like the sea, the market has its rhythms and cycles, its high tides and low tides. Experienced sailors – or traders – learn to read these rhythms, using economic indicators and policy meetings as their compass and map. But what happens when a storm blows in unexpectedly, causing a surprise rate change? This can be as thrilling – and potentially unsettling – as a rogue wave on the high seas.

Let’s take an example. Suppose the central bank of the fictional country of “Economia” has been maintaining a steady interest rate of 2% for a while. Market players are comfortable with this stability, and their trading strategies are aligned with this rate. But then, due to unforeseen economic circumstances, the central bank abruptly hikes the interest rate to 3%.

This surprise move would be like a sudden storm on a calm sea. Forex traders, both domestic and international, would need to quickly reassess their positions. The value of Economia’s currency would likely increase due to higher demand from foreign investors seeking to capitalize on the higher return now available in Economia.

Traders betting on the currency’s depreciation would be hit hard, while those who speculated on a rate increase would make substantial gains. This flurry of activity and the potential for profit or loss is why traders must always be prepared to quickly adjust their sails in response to unexpected changes in the financial weather.

To sum it up, when rates change fast, they can shake up the whole Forex market. So, traders should always be ready to learn and adjust.

The Importance of Interest Rates to Forex Investors

Now let’s understand the importance of interest rates why do interest rates matter in forex trading. The Forex market is a living, breathing entity. And if we think of it as a living body, then interest rates are the heartbeats that help keep it alive and pumping. Let’s delve into why these economic heartbeats are so crucial to Forex investors.

The primary purpose of Forex investors is to buy a currency at a low price and sell it at a higher one, thus making a profit. The question then arises: What makes a currency’s value rise or fall? The answer largely lies in interest rates.

To understand better why interest rates matter in forex trading, let’s take an example. Suppose you’re a global investor with the option to invest in Country A with an interest rate of 1% or Country B with an interest rate of 3%. Which investment would you make? Most likely, you’d choose Country B because a higher interest rate could potentially offer a better return on your investment.

When many investors make similar decisions, the demand for Country B’s currency increases. With higher demand, the value of its currency rises in the Forex market. That’s why a country with higher interest rates often has a stronger currency, making it more attractive to Forex investors.

On the flip side, if a country lowers its interest rates, it might not provide as high a return on investments. This might result in less demand for its currency, which would lower the value.

Thus, interest rates can directly influence the profitability of Forex investments. Forex investors can make informed forecasts about currency value changes and adapt their trading tactics by regularly monitoring the ebb and flow of interest rates.

In summary, interest rates aren’t just figures set by central banks. Think of interest rates like a country’s economic heartbeat. These signals are like the music that Forex trading dances to. Understanding the rhythm of these economic heartbeats is therefore critical for any Forex investor.

Economic Cycles and Interest Rates

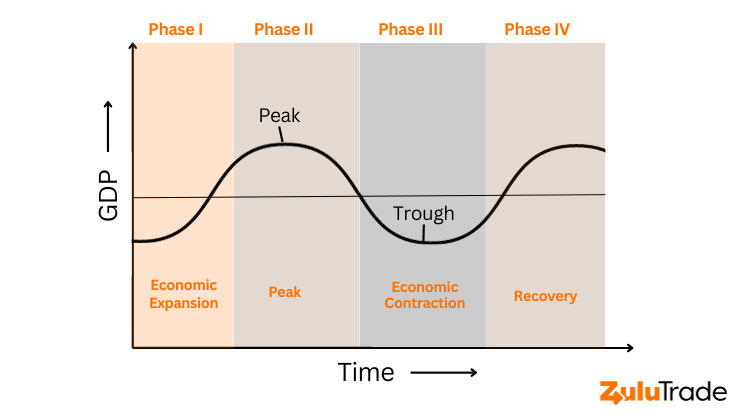

Just as nature has its seasons, the economy has its cycles. These cycles, or phases of expansions and contractions, are an inherent part of any economy. Just as day turns to night, the economy moves through periods of growth (expansion) and decline (contraction). It’s an ongoing cycle, much like the beating of a heart, and just as vital to the organism it serves. And playing a crucial role in this rhythm are the interest rates.

Let’s envision the economy as a cyclist riding on a hilly trail. When the cyclist is going uphill (economic expansion), they pedal harder, their heart rate goes up, mirroring the rise in interest rates set by central banks. When a country’s economy is doing well, it means businesses are making money, lots of jobs are available, and people are buying more stuff. But sometimes, prices start going up too fast, and that’s called inflation. To stop it, the big banks in charge raise interest rates. This increases the cost of borrowing money and slows things down a little.

Now imagine the cyclist starts going downhill (economic contraction). They pedal less, their heart rate decreases, mirroring the fall in interest rates. During an economic downturn, businesses may struggle, unemployment can rise, and consumers may spend less. Sometimes, when an economy needs a boost, the big banks lower interest rates. This makes the people spend more, which can help the economy to grow.

But why should Forex traders care about these economic cycles? Because these cycles provide crucial context for the movements in interest rates. A trader who understands these rhythms can make informed predictions about future interest rate changes. For instance, if signs point towards an economic expansion, traders might anticipate a rise in interest rates and adjust their trading strategies accordingly.

These economic ups and downs don’t stay in one place; they can affect the whole world. Forex traders who understand how different countries’ economies interact might build better plans that will offer them an advantage in the Forex market.

So, knowing how economic cycles and interest rates go hand in hand is super important in the global economy. If you want to do well in Forex trading, this understanding of why interest rates matter in forex trading and how the economic cycles are moving is like having a secret weapon.

How Interest Rates Influence Currencies?

Like puppeteers controlling their puppets, interest rates have a powerful sway over currency values, underscoring why interest rates matter in Forex trading. Think of it as a grand financial puzzle where people try to maximize their returns on investments.

Suppose you’re an international investor deciding between investing in Country A, with an interest rate of 1%, or Country B, boasting a more attractive rate of 3%. Naturally, you’d be inclined to choose Country B; a higher interest rate usually suggests a higher return on investment.

In doing so, you’d exchange your current currency for Country B’s currency to make your investment. And you wouldn’t be the only one! Investors globally would likely make the same decision, leading to a surge in demand for Country B’s currency and thus causing it to appreciate in value.

Now, consider a scenario where Country A’s central bank raises its interest rate to an enticing 4%. Suddenly, the dynamics shift. Investors might begin to move their assets from Country B to Country A to capitalize on this better return. This would involve selling off Country B’s currency in favor of purchasing Country A’s currency. The end result? An increase in demand—and consequently, value—for Country A’s currency, while Country B’s currency could see depreciation due to decreased demand.

In this intricate game, interest rates serve as the invisible strings manipulating the currency values in the Forex market. These shifts and changes in interest rates offer Forex traders opportunities to capitalize on market movements. By grasping the influence of interest rates, traders can make predictive strategic decisions, aligning their sails to catch the most favorable winds.

So, just like a puppeteer has mastery over a puppet’s movements through the careful tug of strings, interest rates similarly guide the ebb and flow of currencies within the Forex market. It’s through this understanding that Forex traders can make more informed decisions, aiming to elevate their trading strategies and boost their profits.

Unpacking Interest Rate Differentials

In the vibrant arena of the Forex market, traders often use a technique called “carry trade” to make a profit. And the star player of this strategy? Interest Rate Differentials, further exemplifying why interest rates matter in Forex trading.

But what exactly are interest rate differentials? Simply put, they represent the gap between interest rates in two countries. Let’s illustrate this with an example.

Imagine two fictional countries – Alpha and Beta. Alpha’s central bank sets its interest rate at 2%, while Beta’s rate is a more attractive 5%. The interest rate differential between Alpha and Beta is 3% (5% – 2%).

As a Forex trader, you spot an opportunity. You can borrow money in Alpha’s currency, where the interest rate is low, and exchange it for Beta’s currency to invest where the interest rate is high. Your goal is to pocket the interest rate differential—in this case, the 3%.

This maneuver is called a carry trade, and it’s a commonly used strategy among Forex traders. It offers a tangible way to capitalize on differences in interest rates between countries.

However, this strategy is not without its pitfalls. Interest rates are not static, and neither are currency values. For instance, if Beta’s currency depreciates relative to Alpha’s, that depreciation could negate the profits made from the interest rate differential.

Thus, interest rate differentials are more than just a nuance; they are a fundamental pillar shaping the dynamics of the Forex market. They underpin strategies like the carry trade, creating opportunities for savvy traders to turn a profit. However, these strategies come with their own risks, making it imperative for traders to stay informed and agile, ever mindful of the constantly evolving financial landscape.

Summing up!

In the exciting world of Forex trading, one big deal is these percentages. Whether they’re going up, down, or staying the same, these Interest Rates matter in Forex Trading. They affect how much your money is worth and how traders make their moves all over the world.

So, next time you hear about interest rates changing, remember: it’s not just about numbers; it can have a big impact on economies, from your own savings to the whole Forex market. Always stay in the know, keep learning, and happy trading!

Frequently Asked Questions (FAQs)

How do interest rate announcements impact the Forex market immediately after release?

When a central bank announces a change in interest rates, this can cause immediate and significant volatility in the Forex market. Traders and investors, anticipating these announcements, adjust their positions based on the actual rate change and the bank’s economic outlook. If the announcement aligns with expectations, the market impact may be minimal. However, if the rates differ from the market’s expectations, there can be substantial swings in currency values.

How can I know when interest rates change in different countries?

Many financial news websites and Forex trading platforms provide regular updates on central bank interest rates worldwide. Subscribing to these platforms, following financial news, and marking the dates of central bank meetings in your calendar are good practices for staying updated.

Is it profitable to always invest in a currency with a higher interest rate?

While it might be appealing to always go for the currency with a higher interest rate, it’s not necessarily the most profitable strategy. You should also think about other stuff like how stable the country’s economy is, if prices are going up too fast (inflation), and how their money’s value is changing. Remember, higher interest rates often come with higher risks.

Can a country have a negative interest rate? If this is the case, how does it affect Forex trading?

Yes, a country can have a negative interest rate, although it’s not common. Negative interest rates mean banks charge customers for holding their money, encouraging them to spend or invest rather than hoard money. This policy is usually a last-ditch effort to stimulate a sluggish economy. When a country has a negative interest rate, it might make its money weaker because it doesn’t look attractive to people from other countries. But remember, the real result can be different, and it depends on what other countries are doing with their money rules.