Hello, traders! We know that diving into the world of Forex trading can seem like navigating uncharted waters. With the multitude of strategies, techniques, and financial jargon, it can be a bit overwhelming. That’s precisely why we’re here, to break down these complex terms and help you make sense of it all.

You’re here because you’ve heard about “fundamental analysis” and “technical analysis,” and you’re curious to know which of these two popular strategies reigns supreme in online trading. We get it; you want to make the most informed trading decisions, and we’re here to help guide you on this journey.

So, grab your favourite beverage, settle in, and keep reading as we demystify these trading strategies. We’ll not only explain what these terms mean but also delve into their differences and discuss when and how each analysis can be beneficial. Whether you’re an experienced trader looking to hone your skills or a newbie starting your trading journey, this article is for you!

Breaking Down Fundamental vs Technical Analysis

Let’s first understand what these terms mean.

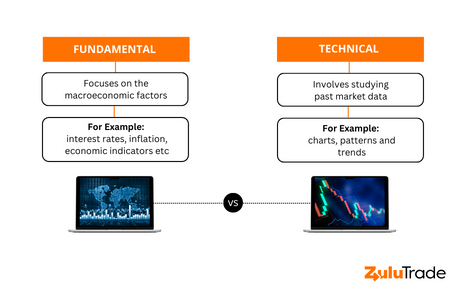

- Fundamental Analysis: This approach focuses on the macroeconomic factors that influence the value of currencies. These can be interest rates, inflation, political stability, economic indicators, and global events. In short, it’s like being a detective, digging deep into a country’s economic health!

- Technical Analysis: This method, on the other hand, is all about charts, patterns, and trends. It involves studying past market data, mainly price and volume, to forecast future price movements. In essence, it’s a little like stargazing, except your stars are graphs, and your constellations are patterns!

Fundamental Vs. Technical Analysis: The Debate

The primary difference between fundamental and technical analysis lies in their approach. While fundamental analysis is a long-term investment strategy focusing on economic conditions, technical analysis is more short-term, using statistical trends to predict future price movements.

So, which analysis is best for the stock market or, in this case, Forex trading?

Well, that’s a bit like asking if an apple is better than an orange; they both have their unique tastes and nutritional benefits, right? Let’s delve a little deeper to understand this better.

The Case for Fundamental Analysis

Fundamental analysis is all about understanding the bigger picture. It provides a comprehensive view of a currency’s value and the factors affecting it. This analysis can be particularly useful for long-term Forex investments. By understanding the economic health of a country, traders can anticipate long-term market trends by carefully considering the major econminc events around the globe.

The Case for Technical Analysis

On the flip side, technical analysis relies heavily on data and patterns. This method is beneficial for short-term trades or ‘day trading.’ If you’re someone who enjoys numbers, graphs, and looking for patterns, this might be your cup of tea!

A Third Option: Sentimental Analysis

But wait, there’s a third contender in the ring: sentimental analysis. This method involves analyzing market sentiment, i.e., the overall attitude of investors towards a particular currency. This form of analysis can help traders understand market trends and predict sudden changes in currency value.

Combining the Three Types of Analysis: The Holy Trinity of Forex Trading

While the debate between fundamental and technical analysis continues, seasoned traders often use a mix of all three types of analysis for a more holistic approach. Understanding economic indicators (Fundamental), recognizing market patterns (Technical), and gauging market sentiment (Sentimental) can all work together to form a robust trading strategy.

The Bottom Line: It's All About Balance

Choosing between fundamental and technical analysis is not about picking the ‘better’ one; it’s about understanding their strengths and limitations. Depending on your investment goals, risk tolerance, and trading style, you might lean more towards one than the other, or you might even decide to use both. After all, in the world of Forex trading, knowledge is power, and a balanced approach can make all the difference!

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Between 74-89% of retail investor accounts lose money when trading CFDs.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.