Knowledge Crunch

In the dynamic financial world, one sector that stands out is foreign exchange, also known as Forex. At the heart of Forex, we find a simple concept: the conversion of one currency into another. Yet, as we peel back the layers, this seemingly simple task unravels a complex and interconnected global market. It’s a place where governments, businesses, and individuals engage in speculation on fluctuating currency prices.

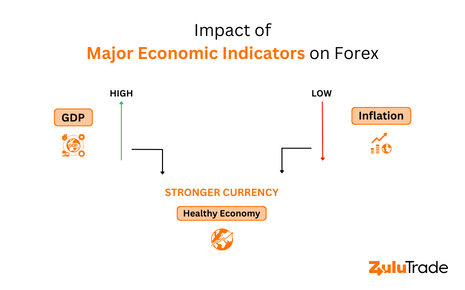

Diving deeper into this ocean of currency exchanges, we find a strong current that moves the Forex market – economic indicators. These metrics reflect the health of a nation’s economy. Parameters such as Gross Domestic Product (GDP), inflation rates, and employment rates directly impact currency values. As traders, understanding these indicators can provide us with a compass, helping us navigate the Forex market’s choppy waters.

However, even with a compass, the journey through these markets can be perilous. That’s why the next stage of our expedition takes us into the realm of risk management. From diversifying portfolios to setting stop losses, we learn the ropes of survival in the unpredictable world of Forex trading.

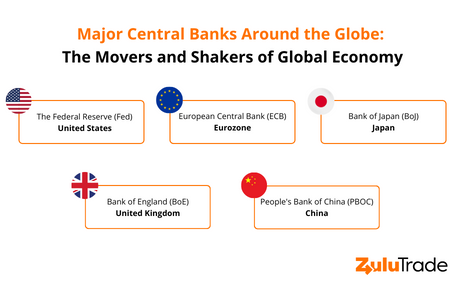

Steering away from risk, we next set sail towards the lighthouses of the Forex market – Central Banks. These financial giants can create waves in the market with their monetary policies, significantly impacting currency values. Understanding their influence can provide valuable insights for traders in this ever-fluctuating market.

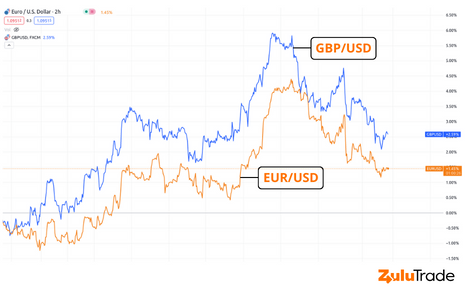

With a firm grasp on economic indicators, risk management, and central banks’ role, we are ready to delve into the core of Forex trading – currency pairs. Currencies are traded in pairs, and the dynamic dance between these pairs fuels the Forex market. Major currency pairs, like EUR/USD, are popular and highly liquid, while minor pairs might not see as much action but still hold opportunities for keen traders.

Just when it seems we’ve covered all aspects of Forex, we stumble upon the wild card in trading – human psychology. The ebb and flow of emotions like fear and greed can often dictate trading decisions. This psychological aspect in trading, which adds a unique twist to the mathematical and economic logic we’ve learned so far, becomes the next piece of the puzzle to explore.

Having tackled the human element, we then transition to an entirely different arena – the impact of technology on Forex trading. The advent of online trading platforms and advanced trading tools have revolutionized Forex trading, making it more accessible and efficient.

But the quest for understanding Forex is far from over. As we deepen our knowledge, we encounter a fork in the road: fundamental analysis and technical analysis. Both pathways offer valuable strategies for interpreting market movements and predicting future trends.

As we wind our way through the maze of Forex, we come across the influence of geopolitical events. The ripple effect of these events on currency values adds another layer of complexity to our Forex trading journey.

The concept of currency correlations soon enters the mix, shining light on how currencies don’t move independently of each other. Understanding these correlations can offer a new perspective, informing our trading decisions and strategies.

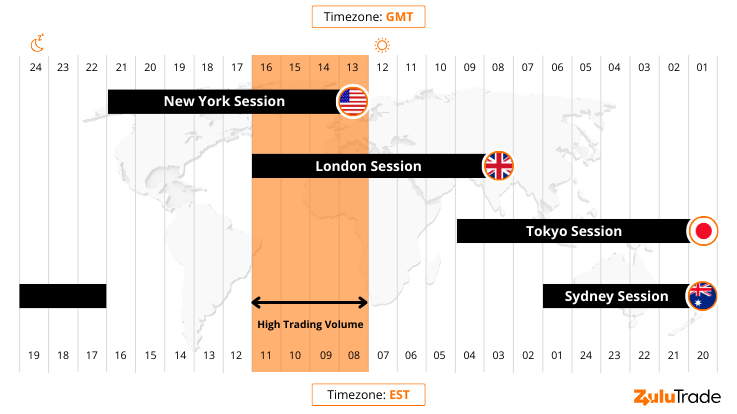

The final leg of our journey lands us in the realm of global trading sessions and their influence on market volatility. The round-the-clock nature of Forex trading brings its own set of challenges and opportunities, concluding our holistic exploration of Forex trading.

By integrating all these different elements, we can see how the story of Forex trading is a complex narrative, full of twists and turns. It’s a tale that continues to evolve and grow, just like the market itself.

As an adventurer seeking to conquer the world of forex trading, you’ve likely asked yourself questions about its 24-hour nature. “What are the forex market hours?” “When’s the best time to trade?” Don’t worry, we’ve got you covered. We understand that these questions are essential to navigate the vast financial oceans, and we’re here to […]

The exciting, fast-paced world of Forex trading isn’t just about charts and numbers. Behind every trade, every decision, is a complex mix of emotions that can make or break a trader’s success. This article will dive deep into the pivotal role of trading psychology, specifically examining the twin influences of fear and greed. If you’ve […]

We know you’re here because you’re passionate about forex trading, and you understand that success in this field requires not only a keen eye for market trends but also a deep understanding of the tools that can optimize your trading strategies. One such tool that often generates a lot of buzz in the trading community […]