Anatomy of Forex Day Trading: From Start to Finish

Hey there, future forex day trader! We understand you’ve been searching high and low for clear, comprehensive information on forex day trading. You’re in the right place! We know how daunting it can be to sift through piles of information, trying to piece together the puzzle of how a successful forex trade works from start to finish.

But worry not! We’re here to take you on a guided tour of a forex trade, breaking down everything from the concept of forex day trading, to trading strategies, indicators, and even the challenges you may face in your trading journey.

In this article, we aim to provide the reassurance you need by answering your burning questions about forex day trading. By the end, we promise you’ll have a solid understanding of the trading process and be ready to take your first steps into the exciting world of forex. So buckle up, and let’s get this journey started!

Understanding Forex Day Trading

Before we dive in, it’s essential to understand what forex day trading is. It’s the practice of buying and selling currencies within a single trading day. The goal is to capitalize on small price movements in highly liquid markets. It’s kind of like fishing, but instead of reeling in fish, you’re reeling in profits (hopefully!).

Forex vs. Stocks Day Trading

Forex day trading is a bit different from stock trading. Unlike the stock market, which has fixed hours, the forex market is open 24 hours a day, five days a week. This gives you more opportunities to find profitable trades, but it also requires a bit more vigilance.

Finding Forex Day Trades

Finding the right trades can be like finding a needle in a haystack, but with the right strategies, it becomes a lot easier. First, you need to keep an eye on the economic calendar because major economic events can create great trading opportunities. Second, you need to analyze price charts and trends. This leads us to our next point – forex trading strategies.

Forex Day Trading Strategies

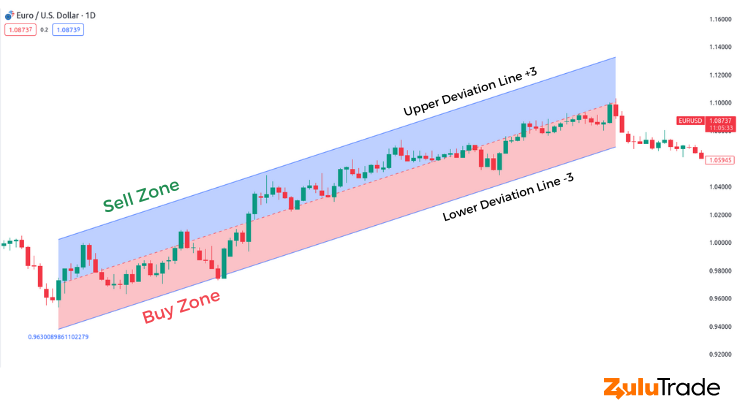

There are two main strategies that traders often use: trend trading and mean reversion.

This strategy involves following the market’s direction, either upward or downward. The key here is to find a strong trend and ride it until there’s a sign of reversal.

This strategy is based on the concept that prices often return to their average price over time. So, when a currency goes too far in one direction, traders using this strategy would expect it to reverse.

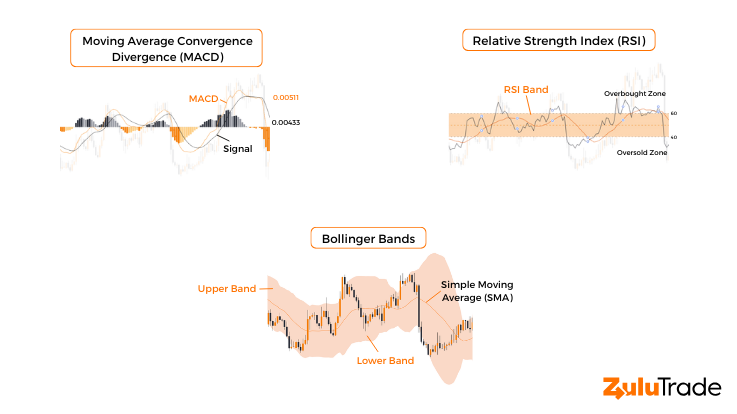

Indicators help you make sense of the market. They’re like weather forecasts for traders. Some of the best ones include the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and the Bollinger Bands. These indicators can help you identify trends and potential reversal points, making them invaluable tools for your trading arsenal.

How to Start Day Trading Forex

Starting in forex day trading is like preparing for a marathon – it requires preparation and training. Start by understanding the forex market and its unique characteristics. Next, educate yourself about forex trading strategies and indicators. Finally, practice with a demo account before risking real money.

Summing up!

Forex day trading can seem a bit daunting at first, but with the right knowledge and tools, it becomes a manageable and potentially profitable activity. Remember, it’s not about making a fortune overnight. Like any other skill, it takes time and practice. So, start slow, learn continuously, and may the forex be with you!

With this, we conclude our trip through the anatomy of a forex trade. From understanding what forex day trading is, differentiating it from stock trading, finding trades, understanding strategies, knowing the best indicators, to finally starting the journey, we’ve covered it all. Happy trading!

FAQs

Is forex good for day trading?

Yes, forex is often considered an excellent market for day trading. There are several reasons for this: the forex market is open 24 hours a day during the weekdays, providing plenty of trading opportunities; it’s highly liquid, meaning you can buy and sell currencies with minimal slippage; and it allows high leverage, which can amplify profits. However, it’s important to note that while these factors can increase profit potential, they can also increase risk.

How much do forex traders make a day?

The earnings of forex traders can vary widely. Some traders might lose money, while others can make thousands of dollars a day. It largely depends on the trader’s strategy, risk management, the size of their trading account, and their experience level. Therefore, it’s difficult to pinpoint a specific number. It’s crucial to remember that forex trading is not a get-rich-quick scheme and requires careful planning and discipline.

Why forex is better than stocks?

While it ultimately depends on an individual’s trading style and risk tolerance, several features might make forex more attractive than stocks to some traders:

- 24-Hour Market: Unlike the stock market, the forex market operates 24 hours a day during the weekdays. This allows traders to trade at their convenience.

- High Liquidity: The forex market has a high liquidity, which means large volumes of currencies can be bought and sold without significantly impacting their price.

- Greater Leverage: Forex trading offers higher leverage than stock trading, which can potentially lead to larger profits. However, leverage can also lead to larger losses.

- Less Complexity: With forex, you’re primarily focusing on a few major pairs, as opposed to thousands of individual stocks.

What is the 1% rule in forex trading?

The 1% rule in forex trading is a risk management strategy where a trader risks no more than 1% of their account balance on a single trade. This means, for example, if a trader has an account balance of $10,000, they should risk no more than $100 on a single trade. The purpose of this rule is to protect the trader’s capital and prevent significant losses from individual trades. It’s a commonly followed principle in many trading disciplines, not just forex.